ACSI: A Measure of Satisfaction with Product and Service Quality

Updated: Dec 9, 2025 Reading time ≈ 8 min

ACSI (American Customer Satisfaction Index) is a national economic indicator that measures consumer satisfaction in the United States. It's one of the best-known standardized indices in the world and is often used as a benchmark for other customer satisfaction programs.

ACSI is based on large-scale surveys, where respondents rate the quality of goods and services provided by companies across multiple industries. The index focuses on:

- perceived product/service quality,

- perceived value,

- overall satisfaction and loyalty intentions.

ACSI is part of a broader customer experience measurement toolkit alongside metrics and loyalty indicators such as Customer Retention, Churn Rate, Repurchase Rate and LTV.

The main goal of ACSI is to show how well companies meet customer needs and how this performance affects economic growth, competitiveness and long-term business health.

What ACSI is Used For

Because ACSI is standardized and comparable across industries, it's widely used by companies, investors, and researchers.

1. Benchmarking and competitive analysis

Companies use ACSI to compare their satisfaction performance with:

- direct competitors in the same industry,

- broader cross-industry benchmarks,

- their own historical scores (trend analysis using time series analysis).

These comparisons reveal strengths, weaknesses, and opportunities for differentiation-and often complement internal metrics such as CSI, NPS, and CSAT.

2. Improving product and service quality

ACSI is built on customer perceptions of quality and value. By digging deeper into the underlying survey data, companies can:

- identify pain points in product features, reliability, or usability,

- spot gaps in service performance using gap analysis,

- prioritize improvements with tools like conjoint analysis or MaxDiff.

This aligns ACSI programs with custdev and VOC (Voice of the Customer) strategies.

3. Strategic planning

ACSI trends show whether satisfaction is rising or falling in a category. That insight supports:

- decisions about market expansion or repositioning,

- product line extensions or discontinuations,

- investment in service channels and customer retention initiatives.

Companies often combine ACSI insights with predictive analysis and financial indicators to forecast long-term impact.

4. Investment and financial analysis

Investors and analysts use ACSI scores as an external signal of:

- customer loyalty and future revenue stability,

- risk of churn,

- the strength of a company's brand and operations.

High and stable ACSI scores often correlate with solid LTV, better yield rates and stronger resilience in downturns.

5. Marketing and communications

Strong ACSI results can be:

- showcased in marketing campaigns,

- highlighted on websites and reports,

- used as proof of service and product quality in B2B pitches.

ACSI complements internal metrics like CSAT and NPS; where NPS captures recommendation intent, ACSI expresses the broader satisfaction context.

6. Policy development and regulation

Government agencies and regulators use ACSI:

- to monitor satisfaction in essential sectors (healthcare, utilities, public services),

- to evaluate the impact of policy changes on citizens' experiences,

- as a macro-level indicator of service quality over time.

This often connects with panel studies and cross-sectional surveys in public sector research.

7. Consumer behavior and academic research

Researchers use ACSI data in both quantitative research and qualitative research to study:

- links between satisfaction, loyalty, and financial performance,

- how expectations, perceived quality, and perceived value drive behavior,

- sector-level trends and the broader economy.

Academic work often uses factor analysis, Z-tests, confidence intervals and time series analysis on ACSI data.

How the ACSI Metric is Calculated

At the respondent level, customers rate three elements on a 1–10 scale:

- Overall satisfaction with the company

- How well the product/service met expectations

- How the company compares to competitors

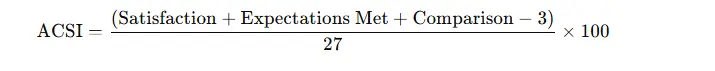

ACSI then uses a weighted formula:

The subtraction of 3 and division by 27 normalize the index to a 0–100 scale.

Example

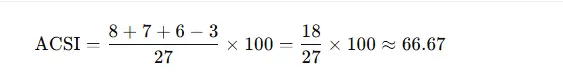

Suppose the average ratings are:

- Satisfaction: 8

- Expectations Met: 7

- Comparison to Competitors: 6

Apply the formula:

An ACSI score of ≈66.67 indicates a moderate level of customer satisfaction, considering experience, expectations, and competitive context.

In the official ACSI model, these items sit inside a broader causal framework that includes perceived quality, perceived value, loyalty, customer retention and complaint rates, analyzed using multivariate regression and structural equation modeling. But the simplified formula is enough to understand the basic logic.

General ACSI Survey Methodology

The ACSI methodology is highly standardized so results are comparable across time and industries. Typical stages:

1. Target audience definition

For each industry, ACSI defines the relevant customer base:

- respondents must have recently used the product or service,

- screening questions ensure they can evaluate the brand meaningfully.

This design helps avoid noisy responses and keeps the sample aligned with real customers.

2. Survey design

ACSI uses a structured questionnaire with:

- core satisfaction questions (those used in the ACSI formula),

- items on expectations, perceived quality, and perceived value,

- loyalty and likelihood of repeat business (linked to retention, churn, Repurchase Rate, Redemption Rate),

- often some qualitative elements for context.

Scales are usually Likert-type 1–10, which allows fine-grained analysis and comparison. Before large-scale rollouts, questions are extensively tested (including cognitive interviewing and pilot studies).

3. Data collection

Data is collected through:

- phone interviews,

- online surveys,

- sometimes mixed modes.

Sampling and fieldwork are designed to minimize bias (e.g., avoiding pure snowball sampling) and ensure that results can be generalized to the broader population.

4. Data analysis

Once responses are collected:

- data is cleaned and validated,

- multivariate regression models estimate how perceived quality and value affect satisfaction and loyalty,

- factor analysis ensures the scale structure is sound,

- confidence intervals and tests like Z-tests quantify differences across time or groups.

This goes far beyond simple averages and supports more nuanced interpretation.

5. Weighting and normalization

To ensure fair and accurate comparisons:

- data is weighted to match population structures (using weighted survey techniques),

- scores are normalized to the ACSI 0–100 scale,

- results are calibrated to maintain consistency over time, even if minor methodological tweaks occur.

6. Index calculation and reporting

ACSI calculates scores for:

- individual companies,

- industries and sectors,

- sometimes entire national economies.

Results are published in detailed reports that include:

- industry trends,

- league tables,

- commentary on macro-level shifts,

- insights for improving products, services, and customer experience.

What is Considered a Normal ACSI Score?

ACSI scores range from 0 (complete dissatisfaction) to 100 (complete satisfaction). What counts as "normal" depends on industry, market expectations, and competitive intensity, but broad guidelines look like this:

- 70 and above – High satisfaction. Typically indicates strong customer relationships and competitive advantage.

- 60–70 – Average satisfaction. Customers are generally satisfied, but notable pain points or inconsistencies exist.

- Below 60 – Low satisfaction. Signals potential issues with product or service quality, UX, or support.

In high-expectation sectors (e.g., airlines, financial services, tech), even a score in the low 70s might only be average. In less competitive or more regulated sectors, lower scores may still be typical.

The most useful comparisons are:

- against industry averages,

- against direct competitors,

- and against your own historical scores (trend over time).

How to Improve Your ACSI Score

Raising your ACSI score means systematically improving how customers experience your product and service. Practical strategies:

1. Listen to customers continuously

Go beyond ACSI itself:

- run ongoing CSAT, NPS, CES/CES 2.0, and CSS surveys,

- analyze VOC from reviews, support tickets, and social media,

- use sentiment analysis to detect themes at scale.

Combine large-scale quantitative research with qualitative methods (IDI, focus groups, ethnographic research) to get a full picture.

2. Improve product and service quality

Use ACSI and related feedback to:

- fix recurring product issues and defects,

- improve usability and UX (measured by SUS, SUPR-Q, UMUX, UEQ, VAS, SEQ),

- refine value propositions and price–value ratio.

Where possible, test changes using experimental research and random assignment (A/B tests) to see which interventions actually move ACSI and related metrics.

3. Strengthen customer service and support

Design service processes that are:

- fast (good FRT and TTR),

- effective (high FCR),

- empathetic and proactive.

Train staff, create clear service standards, and monitor results with post-contact surveys and pulse surveys.

4. Personalize experiences and loyalty programs

Leverage CRM data and RFM segmentation to:

- tailor offers and communications,

- design loyalty programs and redemption mechanics that feel genuinely rewarding,

- identify at-risk customers early and trigger targeted interventions.

This not only improves ACSI but also raises repurchase and retention metrics.

5. Resolve issues quickly and close the loop

Establish clear, easy-to-find complaint channels:

- respond quickly and transparently,

- use each complaint as a source of improvement insight,

- let customers know what changed as a result of their feedback.

Closing the loop is crucial for turning negative experiences into loyalty wins.

6. Invest in people and technology

Combine:

- employee training and VOE programs (employee experience strongly affects CX),

- technology such as CRM, chatbots, and automation to make service more efficient,

- analytics tools and dashboards to monitor ACSI, CSI, CSAT, NPS, CES, retention, churn, and LTV together.

Improving ACSI is not about chasing a number once per year-it's about building a continuous feedback and improvement system.

Updated: Dec 9, 2025 Published: Jun 2, 2025

Mike Taylor

Mike Taylor